Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of ez irs income?

EZ IRS Income is an online tool designed to help taxpayers prepare, file, and submit their federal income tax returns. It provides step-by-step guidance to complete forms, check accuracy, and submit returns. It also provides links to helpful tax information and assistance from IRS.gov.

What information must be reported on ez irs income?

The information that must be reported on EZ IRS Income includes:

1. Wages, salaries, tips, and other employee compensation

2. Interest income

3. Dividends

4. Capital Gains

5. IRA distributions

6. Social Security Benefits

7. Business income

8. Rental income

9. Unemployment compensation

10. Pension income

11. Alimony received

12. Other income

There is no specific term or concept called "ez IRS income." However, "EZ" usually refers to Form 1040-EZ, which was a simplified tax form that individuals with relatively simple tax situations could use to file their federal income tax return. However, the IRS has discontinued Form 1040-EZ starting with tax year 2018, and taxpayers are now required to use Form 1040 or Form 1040-SR.

Who is required to file ez irs income?

Individuals who have a simple tax situation and meet certain criteria can file Form 1040EZ, also known as an EZ IRS income tax return. However, it is important to note that starting from the tax year 2018, the IRS has eliminated Form 1040EZ and the 1040A. Thus, individuals now need to use Form 1040 for filing their federal income tax return.

How to fill out ez irs income?

To fill out the IRS Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents), follow these steps:

1. Gather your information: Collect all necessary documents such as your W-2 forms, 1099 forms, and any other income-related documents like interest earned from a bank account or unemployment compensation.

2. Personal information: Enter your personal information such as your name, Social Security number, address, and filing status (single or married filing jointly).

3. Exemptions: Indicate any exemptions you may be eligible for. The 1040EZ assumes you have no dependents, so you'll skip this section.

4. Income: Report your total income in the appropriate lines of the form. This may include wages, salaries, tips, taxable interest, unemployment compensation, and any other sources of income.

5. Taxable income: Subtract any deductions (standard deduction or earned income credit) from your total income to calculate your taxable income.

6. Credits and payments: If applicable, claim any tax credits and payments you qualify for, such as the Earned Income Credit or any federal tax withheld from your paycheck.

7. Calculate your tax: Use the tax table provided in the instructions to find your tax liability based on your taxable income and filing status.

8. Refund or amount owed: Compare the total tax you owe with the total payments you made (including withholding and any estimated tax payments). If you overpaid, you will receive a refund. If you owe money, you'll need to make a payment.

9. Sign and date: Sign and date the form to certify that the information provided is true and accurate.

10. File the form: Mail the completed 1040EZ form to the appropriate IRS address, which can be found in the instructions. Alternatively, you can e-file your tax return using IRS-approved tax software or through a tax professional.

Always consult the official IRS instructions or seek professional tax advice for specific guidance tailored to your situation.

When is the deadline to file ez irs income in 2023?

The deadline to file Form 1040EZ or any other income tax return with the IRS for the tax year 2022 would typically be April 17, 2023. However, it's important to note that tax deadlines can sometimes vary, so it's recommended to confirm the exact deadline with the IRS or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of ez irs income?

The penalty for late filing of Form 1040EZ with the IRS (Internal Revenue Service) is typically calculated based on the amount of unpaid taxes owed and the duration of the delay. As of 2021, the penalty for filing after the deadline is usually 5% of the unpaid taxes per month, up to a maximum of 25% of the unpaid amount. However, if you file more than 60 days after the due date, the minimum penalty is either $435 or 100% of the unpaid tax, whichever is smaller. It's important to note that specific penalties may vary depending on individual circumstances, and additional penalties or interest may apply for failure to pay the taxes owed. It is always recommended to consult with a tax professional or refer to the IRS guidelines for precise penalty calculations.

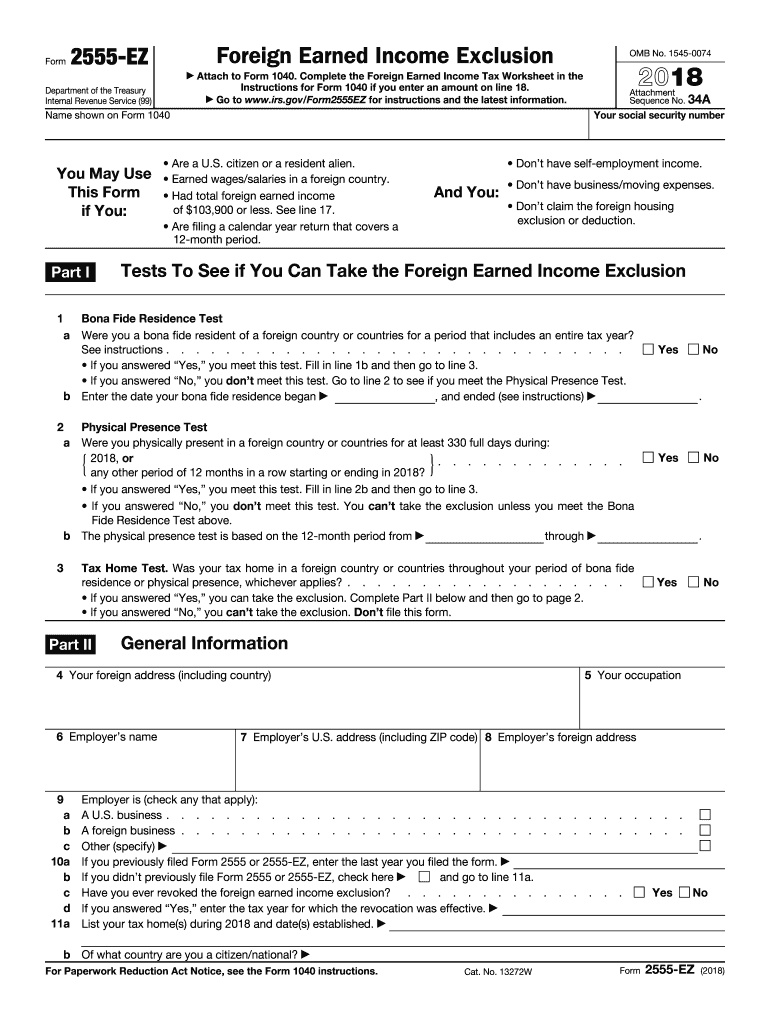

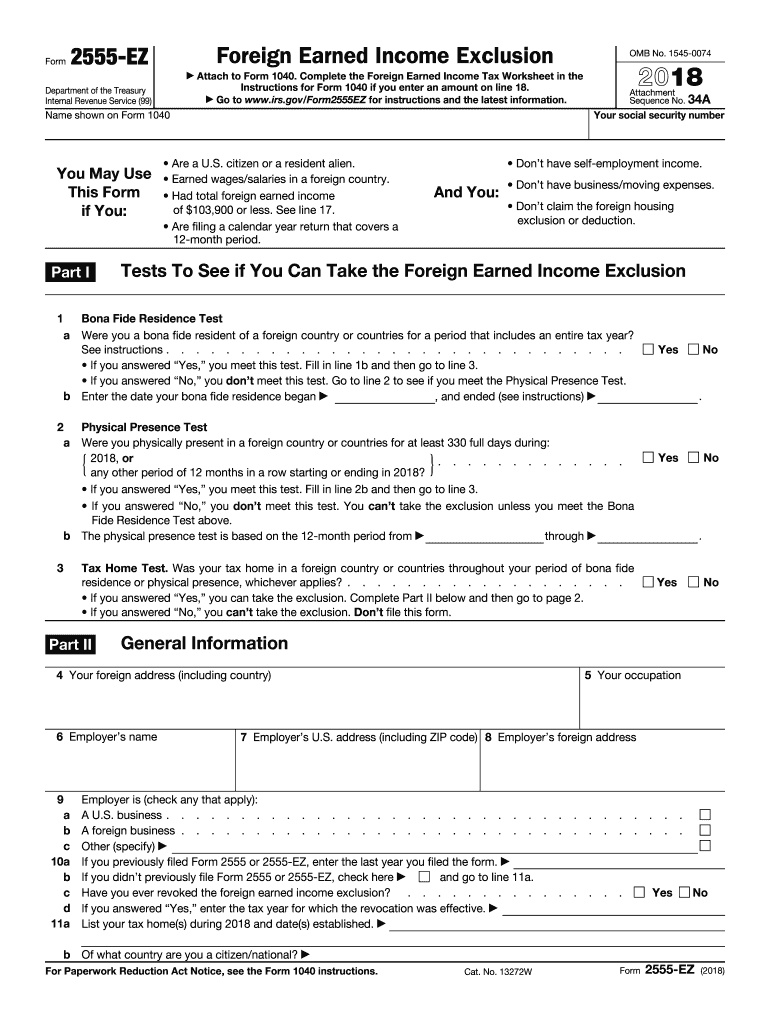

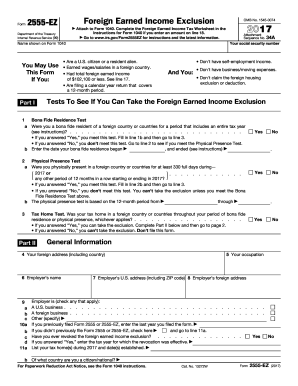

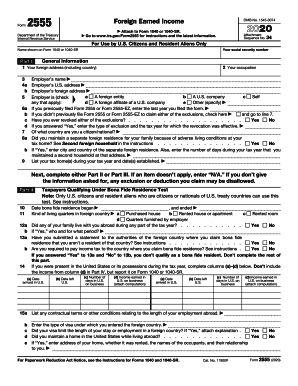

How can I edit 2555 ez form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 2555 irs pdf form into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the 2555 ez electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your form 2555 instructions in seconds.

How do I fill out form 2555 ez 2022 on an Android device?

Use the pdfFiller app for Android to finish your irs form 2555 ez. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.